by Alan Unell, Ph.D.

We the people give businesses a huge break when we make them tax exempt. We make sure that they pay no federal or state corporate income taxes because they are involved in doing good for the public. The IRS has special rules regarding public good for hospitals. Here is a link to the law.

Unfortunately those rules, and most of the state rules on the subject are vague and allow hospitals to decide what constitutes public good. Some have found advertising campaigns constitute public good, in that their ads contained a public health message inside an advertisement. Many tax exempt hospitals sell the debt of patients unable to pay to collection agencies and many of those patients wind up in bankruptcy. I don’t know about you, but in my mind , treating people unable to pay constitutes the greatest good a hospital could possibly do.

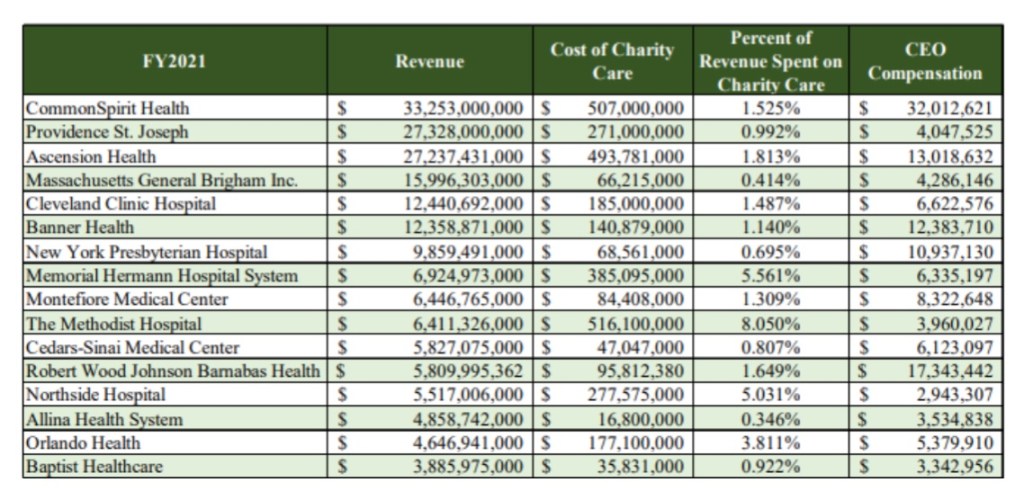

Yesterday Senator Bernie Sanders released a report on the subject. He is chairman of the Senate Health, Education, Labor and Pensions committee. He found six of the biggest nonprofit hospital systems dedicated less than 1% of their total revenue to charity care in 2021 — what should be a key criteria for maintaining their tax-exempt status.

One study, mentioned in the report, found that in 2017 tax exempt hospitals billed patients $2.7 billion when they should have eligible for charity care. Hospitals make it hard to figure out how to access charity care that they are supposed to offer. The reference is in the linked report(#12)

This chart was in the report and it is quite an eye opener.

Look at CommonSpirit Health. They spent 1.52% of revenue on charity care and paid their CEO $32 million. Or New York Presbyterian, with 0.695% spent on charity care and almost $11 million for their CEO.

While we are at it, another study found that the amount spent of charity care is far less than the amount of the tax breaks they get from the government. Non-profit hospitals spent only an estimated $16 billion on charity care in 2020, or about 57 percent of the value of their tax breaks in the same year. The reference is in the linked report (#10). There are a little more than 6000 hospitals in the US and about 3000 are non profit and tax exempt. Yet they make 44% of their profit from the federal, state and local tax breaks. WHAT A SCAM!!!

Even the General Accounting Office has weighed in and found this to be shameful. To quote their recent report to be Tax Exempt a hospital must

- Meet legal requirements, e.g., set billing and collection limits

- Provide community benefits, e.g., run an emergency room that’s open to all—regardless of ability to pay

While the legal requirements are easy for IRS to confirm, it’s harder to verify community benefits because the law isn’t specific about which services qualify. Revising tax forms so hospitals can better share such information may help justify exemptions. Their prior report asked Congress to consider clarifying the law and recommended ways to improve IRS oversight.

We can do more – let’s let our legislature know how tax exempt hospitals have found a way to scam the system and pay exorbitant salaries to CEOs, pay little for charitable healthcare, sell patients debt to collection agencies and force the now indigent patients into bankruptcy.

ACTION

Lets educate our representatives about this and ask them to implement firm IRS tax rules about how much charitable healthcare has to be offered to maintain their tax exempt status. A tithe or 10% sounds fair. Also they should make sure hospitals make it easy to apply for charitable care, not hide that information and they should not be involved in aggressive bill collection activities (as some are). The reference section below has their contact info.

You can use RESISTBOT by texting to 50409 SIGN PSTWKL to send the email below.

“I am your constituent and I just learned that tax exempt hospitals are providing very little charitable care compared to their income. 6 of the top 16 tax exempt hospitals provide less than 1%. They are involved in aggressive bill collection, sell debt to collection agencies and drive patients into bankruptcy – and we are subsidizing this. Moreover, the charitable care they provide is vastly outweighed by the tax benefit they receive. In fact for the almost 3000 tax exempt hospitals, 44% of their profit is from their tax benefits.

I refer you to the report submitted to the Senate’s Health Education Labor and Pensions Committee by it’s chair, Senator Sanders, on October 10, 2023. Here is a link. https://www.sanders.senate.gov/wp-content/uploads/Executive-Charity-HELP-Committee-Majority-Staff-Report-Final.pdf

Here is what you can do. You can pass legislation that in order to maintain tax exempt status, hospitals must provide at least 10% of their income as charity care to the poor. You can demand that they publish easy to find instructions on how to apply for charity care. I want you to do this for all of us.”

Dr Unell’s blog can be found on Substack.